Blog adapted from sunbeltmidwest.com

By Peggy DeMuse Licensed Business Broker, Sunbelt Business Advisor, Featured in Upsize Magazine

When a business owner is planning their exit strategy, they should seek to minimize risk and maximize net proceeds from the sale. Seller financing can be a powerful tool in this regard.

SELLER FINANCING DRIVES HIGHER PRICES

Business buyers are also looking to reduce risk. And the fact is, an all-cash deal has more risk than a deal where the seller finances a portion of the transaction. The mere existence of seller financing shows a buyer that the seller has confidence in the future. The seller still has skin in the game. If there are post-closing issues, the buyer is confident the seller will be responsive if their feedback is needed.

This reduction of risk leads to higher offers. Deals are typically financed for five years or fewer. And it is well known in the deal making world that cash offers are often discounted by buyers.

SELLER FINANCING ALLOWS FOR CREATIVE DEAL MAKING

Most business owners only sell a business once. And they usually start the process with a bias against seller financing because of the risk. What they don’t understand is they are likely leaving dollars on the table if they insist on all cash as discussed above.

What they also don’t realize is that all cash deals invite another party to the table — a bank. Buyers want leverage and bank financing gives them that leverage. Unfortunately, along with the banks’ capital comes a lot of requirements.

With seller financing, the business does not need to go through underwriting at the bank. Occasionally, banks can put doubt in buyers’ minds. Some examples where bank financing might not be the best option are:

- Bank financing requires certain debt-to-income ratios, seller financing does not. There are many discretionary expenses that owners will run through their business that can be added back to arrive at the profitability of the business. The banks do not consider all of these expenses, which in turn, results in a lower valuation.

- Banks also shy away from businesses with significant customer concentration, even if strong long-standing relationships are in place.

- If there has been a recent drop in revenue, this can also be a problem for bank financing. In the current environment, banks are getting tighter with lending and don’t have as much capacity as they have had in recent years. This has, in many cases, made seller financing the only option.

While a buyer will generally be required to pay a larger down payment for seller financed deals than bank financing would require, there are some benefits to the buyer as well. Banks will typically have variable loan rates, whereas seller financed notes tend to have a fixed rate, making payments predictable for a buyer. In addition, with SBA financing, if a buyer has equity in their home, the bank will require the home to be put up as additional collateral on the loan, regardless of the strength of the business.

SELLER FINANCING DRIVES ROI, SAVES ON TAXES

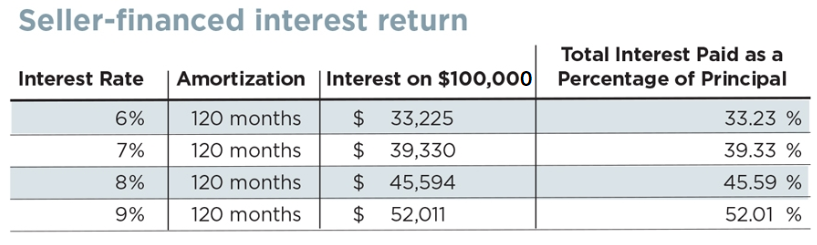

Another appealing benefit of seller financing is that Interest rates are currently running between 7-8 percent for seller financed businesses. This is a great rate of return for most sellers (see table above).

Additionally, by taking the sale proceeds over time, the seller can be taxed on the sale as the proceeds are received. This can result in significantly lower taxes than if all proceeds were recognized in the year of sale, which could push the seller into a much higher tax bracket.

RISK MITIGATION

If seller financing sounds like the right option for a business owner, they will need to look for a strong buyer with transferable skills, a strong credit score and a reasonable cushion in case of a down year. The seller is now the bank and should think like a bank. Is the deal structured in a way that allows for reasonable repayment of the debt structure? Does the buyer have enough cash flow to allow for capital expenditures and unexpected one-time expenses? What reserves does the buyer bring to the table for investment?

The seller should request regular financial statements and annual tax returns from the buyer until the note is paid in full. The note should also be secured by the assets of the business and personal guarantee of the buyer.

MAXIMIZING YOUR LIFE’S WORK

Properly structured seller financing will drive higher offers, allow for creative deal making, create significant return on investment for the seller on interest earnings and create tax mitigation opportunities. Work with an experienced business broker or mergers and acquisitions adviser to understand if seller financing is right for you.

Lisa Meyer, licensed business broker, Sunbelt Business Advisors, contributed to this article

Click here to read the original article featured in Upsize Magazine